Financial Ratio Analysis

Financial Ratio Analysis의 설명

Financial statement analysis (or financial analysis) is the process of reviewing and analyzing a company's financial statements to make better economic decisions. These statements include the income statement, balance sheet, statement of cash flows, and a statement of retained earnings. Financial statement analysis is a method or process involving specific techniques for evaluating risks, performance, financial health, and future prospects of an organization.

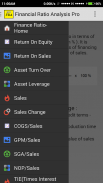

Financial ratios are very powerful tools to perform some quick analysis of financial statements. There are four main categories of ratios: liquidity ratios, profitability ratios, activity ratios and leverage ratios. These are typically analyzed over time and across competitors in an industry.

1. Profitability ratios are ratios that demonstrate how profitable a company is. A few popular profitability ratios are the breakeven point and gross profit ratio. The breakeven point calculates how much cash a company must generate to break even with their start up costs. The gross profit ratio is equal to (revenue - the cost of goods sold)/revenue. This ratio shows a quick snapshot of expected revenue.

2. Liquidity ratios are used to determine how quickly a company can turn its assets into cash if it experiences financial difficulties or bankruptcy. It essentially is a measure of a company's ability to remain in business. A few common liquidity ratios are the current ratio and the liquidity index. The current ratio is current assets/current liabilities and measures how much liquidity is available to pay for liabilities. The liquidity index shows how quickly a company can turn assets into cash and is calculated by: (Trade receivables x Days to liquidate) + (Inventory x Days to liquidate)/Trade Receivables + Inventory.

3. Leverage ratios depict how much a company relies upon its debt to fund operations. A very common leverage ratio used for financial statement analysis is the debt-to-equity ratio. This ratio shows the extent to which management is willing to use debt in order to fund operations. This ratio is calculated as: (Long-term debt + Short-term debt + Leases)/ Equity.

4. Activity ratios are meant to show how well management is managing the company's resources. Two common activity ratios are accounts payable turnover and accounts receivable turnover. These ratios demonstrate how long it takes for a company to pay off its accounts payable and how long it takes for a company to receive payments, respectively.